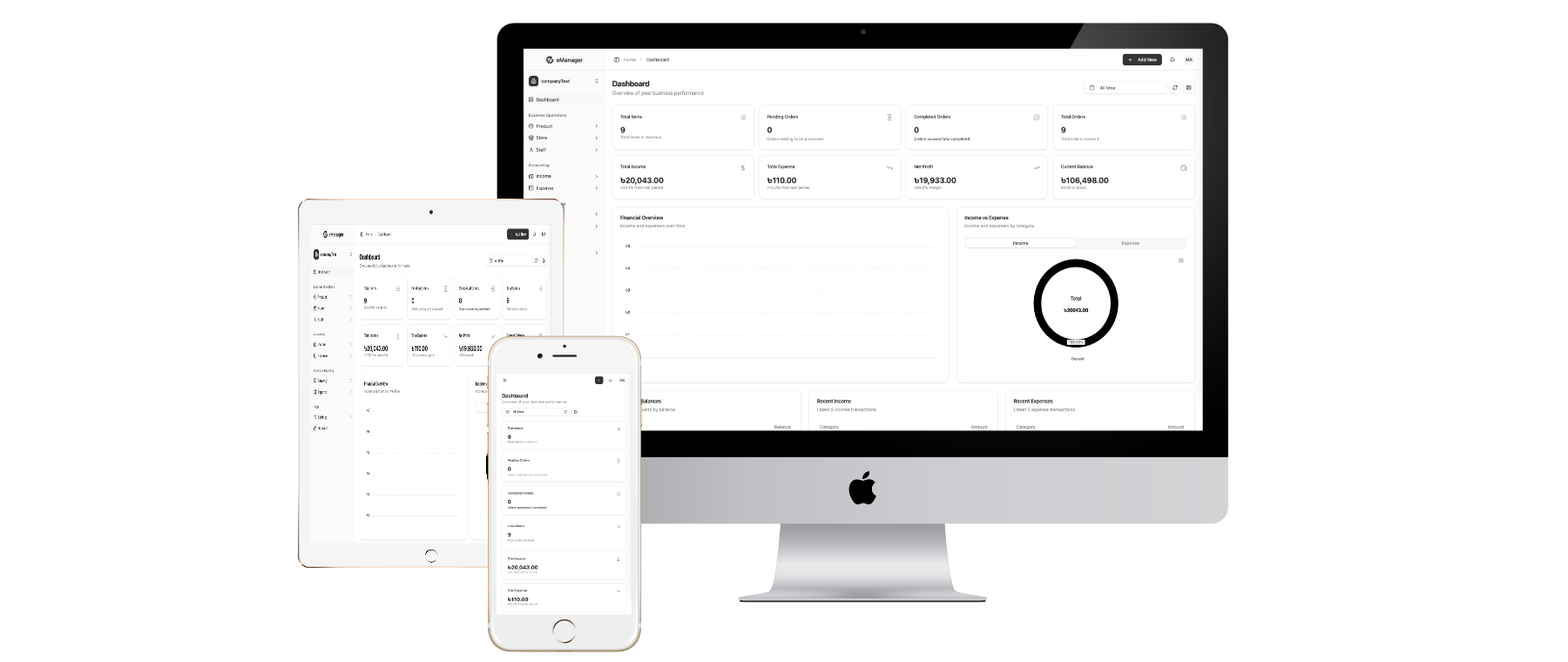

Running a business is hard when your inventory doesn’t match your invoices. E-manager eliminates the manual work so you can focus on growth.

Inventory, Invoicing, and your own Online Store. Manage it all in one Free Inventory Management App.

Inventory, Invoicing, and your own Online Store. Manage it all in one Free Inventory Management App.

Running a business is hard when your inventory doesn’t match your invoices. E-manager eliminates the manual work so you can focus on growth.

Never run out of stock again. Print QR labels, scan to update, and track variants instantly with free inventory management

Invoices, Bills, and Expenses—linked automatically. Generate P&L reports with one click, not one week of math.

Turn your inventory into a public e-commerce store in seconds. Let customers order directly while you sleep. Check docs.

Assign Roles (Manager, Staff, Accountant). Keep sensitive data safe while giving your team the tools they need.

”E-manager saved us 10 hours a week on inventory counts.

Abdul Kader AkibCEO & Founder

”E-manager makes my business accounting easy and clean.

Jordan StantonCEO & Founder

”For getting updates about my business, I just take a look on E-Manager

Karly RosaCEO & Founder

Still have questions, contact us